How to IDOC

A lot of you in the Class of 2020 have recently been notified of the Institutional Documentation Service (IDOC) requirement for your financial aid, and we’ve heard a lot of great questions from you all. I’ve put together a couple of the most popular questions (and solutions). Share this with your family and you’ll be equipped to tackle IDOC head-on!

Don’t worry too much about that March 1 deadline; IDOC mandates that we put down a “deadline,” but we’ll continue to accept IDOC information leading up to the May 1 deposit deadline.

1. What is IDOC?

IDOC is a document imaging and management service provided by College Board to many colleges and universities. IDOC makes submitting financial documents more secure and convenient. Before IDOC, you’d have to submit individual copies of your tax information to every school on your list. Depending on how many schools you applied to, you were sending out as many as ten copies of your family’s private information to different offices all over the country.

With IDOC, you only need to submit one copy of your tax information directly to College Board. From there, either your family or the College Board uploads the information to a secure server only available to financial aid officers at the schools that you’ve applied to. College Board shreds any paper information they receive, so you and your family don’t have to worry about multiple copies of your documentation circulating.

2. So, what do I need to submit?

Most of the information that you submit is 2015 tax forms from you and your parents/guardians. But for some families, taxes can entail dozens or even hundreds of pages! So, does Rochester really need everything? The short answer: no.

First and foremost, we’ll only need your family’s federal tax information. We always need your 1040 tax return and statements of earnings such as W2s and 1099s. Beyond that, there are multiple tax “schedules” that may or may not be filed with the 1040 depending on your family’s unique financial circumstances. Some of the most commonly required are Schedule C (for small businesses), Schedule E (for rental and royalty income), and Schedule F (for family-owned farms). Chances are, if it’s a federal tax form labeled “Schedule _”, Rochester will ask for it if we don’t receive it with your initial submissions.

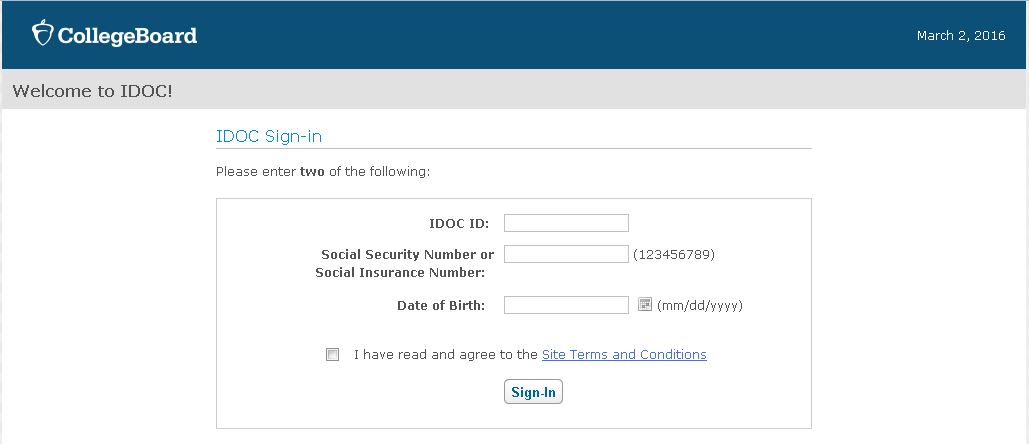

The remaining, non-tax forms that you may need to submit are in the IDOC online portal. For example, the IDOC Verification Worksheet is required for everyone. If you or your parents/guardians didn’t file taxes in 2015, there are designated Non-Tax Filer Statements that you’ll need to complete.

At the end of the day, if you’re unsure whether a certain form is necessary, contact your financial aid counselor. We’ll reach out after your initial submission if we need anything further, but it’s a lot less work for you and your family to send in everything at once.

Other IDOC-participant schools you’ve applied to might need additional information that Rochester doesn’t, so don’t assume that this information applies to other colleges or universities. Just like with Rochester, you can always reach out to their financial aid offices for clarification.

3. What if my family’s 2015 taxes aren’t ready yet?

We recognize that plenty of families don’t file their taxes until closer to the federal deadline, and some families need extensions and won’t finish filing until summer or fall.

If your 2015 taxes won’t be ready for a few more weeks or months, we can create a baseline aid package for you based on your 2014 information. If this is the case for your family, you can choose to send all the relevant 2014 documents directly to the Financial Aid Office. Emailing the documents to your counselor or faxing them to our office is usually the quickest and securest way of submitting the information, but you can also send a packet via mail if that is most convenient for you.

Once the 2015 taxes are filed and finalized, you can submit them through the IDOC process. We’ll update your aid package once we’ve received the newer figures, so it may change compared to your initial award. The good thing is that you’ll probably have an idea of what the changes will be by comparing the two sets of documents. If your family made more in 2015 than in 2014, you can expect that your aid eligibility might go down, for example.

As always, the most important thing is to let us know what specific questions you have. Each family’s financial circumstances are so unique that there’s no requirements catch-all. Give us a call or email us if you have questions, and your counselor will be happy to help.